Arkansas Gross Up Paycheck Calculator

Table of Content

Check Arkansas’s withholding method in our free Payroll Resources. Taxable Income in Arkansas is calculated by subtracting your tax deductions from your gross income. So why do people choose not to claim income tax deductions in Arkansas?

First, we calculate your adjusted gross income by taking your total household income and reducing it by certain items such as contributions to your 401. If a state has zero income tax, this usually means they find creative ways to tax you in other ways in order to compensate. For example, this could potentially be through higher property taxes, higher sales taxes, fewer state services, fewer state benefits, etc. Obviously, each state will be different and this may not be the case in every state.

Arkansas Hourly Paycheck Calculator

Deductions can lower a person's tax liability by lowering the total taxable income. Bonuses are taxed either by using the percentage method or the aggregate method. PaycheckCity has both percentage and aggregate bonus free calculators. Most of your employees won’t have any post-tax deductions, but if they do, you will need to withhold things like court-ordered wage garnishments, child support, etc. First and foremost, let’s talk about federal payroll taxes.

In almost all cases, your employer will automatically withhold this amount from your paychecks and thus your take home pay should be around 0 per year or 0 per month. Note that this estimate is based only on the most common standard deductions and credits, if any. If you are eligible for additional deductions and credits, your taxes may differ. There are six personal income tax brackets that range from 0.9% to 7%. Use the Arkansas hourly paycheck calculator to see the impact of state personal income taxes on your paycheck. The federal income tax is a progressive tax, meaning it increases in accordance with the taxable amount.

What is state income tax (SIT)?

The state income tax system in Arkansas has 3 to 6 different tax brackets depending on the level of your income and what category it falls into. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. Employees can log into to verify their wages and confirm their benefits at various retirement ages. To understand your paycheck better and learn what are FIT, SUI, SDI, FLI, WC, and other taxes, check the payroll results FAQs below the results.

Arkansas residents have to pay taxes just like all U.S. residents. For federal income taxes and FICA taxes, employers withhold these from each of your paychecks. That money goes to the IRS, who then puts it toward your annual income taxes, Medicare and Social Security. The information on your W-4 is what your employer uses to figure out how much to withhold for federal taxes. That’s why you need to fill out a W-4 whenever you start a new job.

Finance Calculators

Use ADP’s Arkansas Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. An employer might choose to distribute earnings by check, but more commonly these days the pay is deposited directly into the employee’s checking account automatically, based on the pay frequency.

To calculate multi-state payroll for your employees, try PaycheckCity Payroll for free. They are taxed with what’s called the supplemental wage rate. Use our Bonus Calculators to see the paycheck taxes on your bonus.

While we try our best to stay up to date with changes in tax codes, we make no guarantee our salary calculator will be accurate. If you notice a major miscalculation or error with our salary calculator , feel free to direct message us on twitter and let us know. However, if you have specific tax questions, please consult a licensed tax professional. Additional careful considerations are needed to calculate taxes in multi-state scenarios. Learn more about multi-state payroll, nexus and reciprocity in this Multi-state Payroll guide.

This Arkansas hourly paycheck calculator is perfect for those who are paid on an hourly basis. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice.

If you're comparing job offers from different states, it's just something to be aware of. The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another.

It also uses five-step system that lets you enter personal information, claim dependents and indicate any additional jobs or income. In the U.S., the concept of personal income or salary usually references the before-tax amount, called gross pay. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. However, in the context of personal finance, the more practical figure is after-tax income because it is the figure that is actually disbursed. For instance, a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next month's rent and expenses by using their take-home-paycheck amount.

There are no local income taxes on wages in the state, though if you have income from other sources, like interest or dividends, you might incur taxes at the local level. That means you pay the same income tax rates as you do for other income in the state. Long-term capital gains receive an exemption of 50%, meaning that 50 cents of every dollar are not taxable. The exclusion does not apply to short-term capital gains, which are 100% taxable at regular income tax rates. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

All you need to do for this is fill in the appropriate line on your W-4 with how much you want withheld. Depending on how much you overpay, you may get some of this extra money back come tax season. As a result, you might choose to do this if you tend to owe a lot when you file your taxes. In our paycheck calculators, SUI is used to refer to the unemployment tax paid by the employee. SUTA and SUI are payroll taxes that employers, and in some states employees, have to pay to their state unemployment fund.

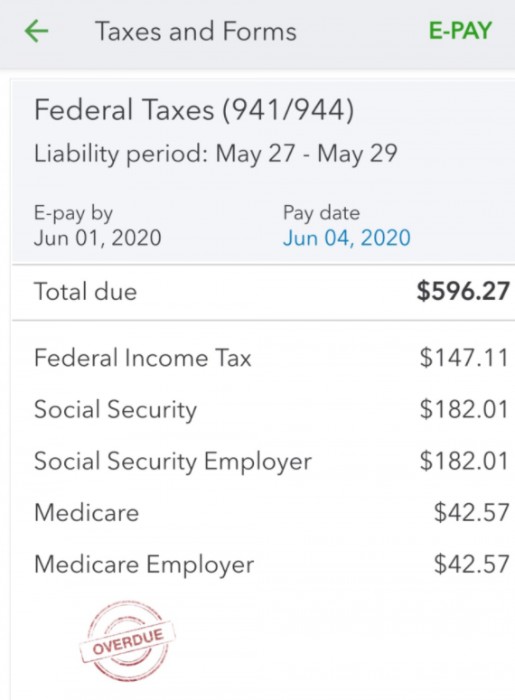

6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 ($160,200 for 2023). So any income you earn above that cap doesn’t have Social Security taxes withheld from it. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. Your FICA taxes are your contribution to the Social Security and Medicare programs that you’ll have access to when you’re a senior.

Prepared foods face the full rate and many localities levy additional taxes on restaurants. Although Arkansas does not have a personal exemption, it does have a personal tax credit that reduces tax liability by $29 for each filer and each dependent. By using Netchex’s Arkansas paycheck calculator, discover in just a few steps what your anticipated paycheck will look like. Income tax calculators from other sites may show slightly different numbers due to different deductions/credits being included or they are based on data from a different year. A married couple with an annual income of $92,000 will take home $72,836.50 after taxes.

Comments

Post a Comment