How to Calculate Your Paycheck in Arkansas

Table of Content

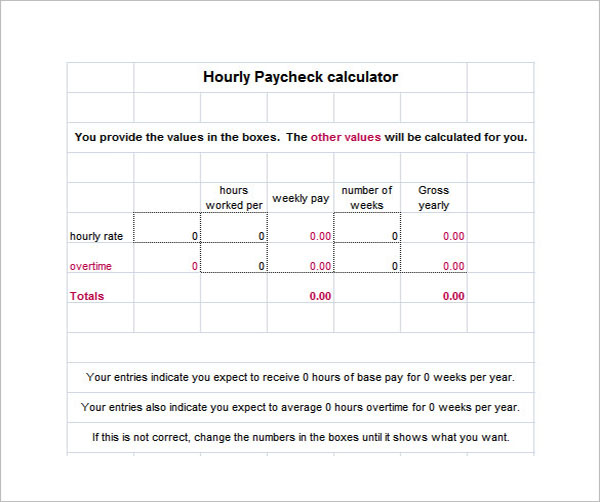

An easy, time-saving payroll solution for your small business. While it might sound good to get a large return, remember that if you had access to that money throughout the year, you could have put it toward something else, like a down payment or your retirement savings. By overpaying the IRS all year, you’re essentially giving them an interest-free loan. If you’re a new employer (congratulations on getting started!), you pay a flat rate of 3.1% (this is including a 0.3% stabilization tax). Hourly individuals must enter their hourly rate and number of straight time, time and 1/2 and double time hours. The IRS has changed the withholding rules effective January 2020.

If you're comparing job offers from different states, it's just something to be aware of. The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another.

Arkansas Gross-Up Calculator

- We regularly check for any updates to the latest tax rates and regulations. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your company’s health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

On the first $10,000 in wages paid to each employee in a calendar year. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Your location will determine whether you owe local and / or state taxes. In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty. However, depending on the severity of the financial situation, a case could be made for at least contributing as much as possible towards what an employer will match for a 401. Figures entered into "Your Annual Income " should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount .

Arkansas Income Tax Brackets and Other Information

If your employer matches your retirement contributions, you will want to make sure that, at the bare minimum, you are contributing enough to take full advantage of that match. Use this Arkansas gross pay calculator to gross up wages based on net pay. For example, if an employee receives $500 in take-home pay, this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. It determines the amount of gross wages before taxes and deductions that are withheld, given a specific take-home pay amount.

Instead, tax brackets vary based on whether your income is categorized as being below or above a certain amount. An annual income of $84,500 or less see tax rates that range from 0% to 5.5%. Currently, 43 states and territories impose a state income tax . Generally, employees will pay SIT based on where they live. Most states calculate their tax similarly to federal methods. They have their own state withholding form and tax brackets and depend on the employee’s marital status and specified withholding allowances.

Self-service payroll for your small business.

Arkansas residents have to pay taxes just like all U.S. residents. For federal income taxes and FICA taxes, employers withhold these from each of your paychecks. That money goes to the IRS, who then puts it toward your annual income taxes, Medicare and Social Security. The information on your W-4 is what your employer uses to figure out how much to withhold for federal taxes. That’s why you need to fill out a W-4 whenever you start a new job.

If you make contributions to a retirement plan like a 401 or a health savings account , that money will also come out of your paycheck. However, those contributions come out of your paycheck prior to taxes, so they lower your taxable income and save you money. The aggregate method is used if your bonus is on the same check as your regular paycheck. Your employer will withhold tax from your bonus plus your regular earnings according to your W-4 answers. Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security.

Does Arkansas collect personal income tax?

A flexible spending account is a tax-advantaged account that is usually offered by employers to their employees so they have the ability to set aside some of their earnings. Because contributions into an FSA are deducted from paychecks during payroll before income taxes, less income will be subject to taxation. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes. Currently, there are three tax brackets in Kansas that depend on your income level.

Select an alternate state, the Arkansas Salary Calculator uses Arkansas as default, selecting an alternate state will use the tax tables from that state. Bonuses, commissions, and tips are all part of gross wages as well. The gas tax in Arkansas is 24.5 cents per gallon of regular gasoline and 28.5 cents per gallon of diesel. Prescription medicine is entirely exempt from sales tax, as are sales of durable medical equipment such as wheelchairs, prosthetic devices or oxygen tanks.

The following steps allow you to calculate your salary after tax in Arkansas after deducting Medicare, Social Security Federal Income Tax and Arkansas State Income tax. Some states tax bonuses, which are also called supplemental earnings. Find Arkansas’s supplemental rate in our Payroll Resources under “Withholding Requirements”. Just share some basic information, then we’ll set everything up and import your employees’ information for you.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. The calculation is based on the 2022 tax brackets and the new W-4, which, in 2020, has had its first major change since 1987. The only state-level tax is the income tax rate (0% to 5.5%).

Comments

Post a Comment