Results Arkansas Hourly Paycheck Calculator

Table of Content

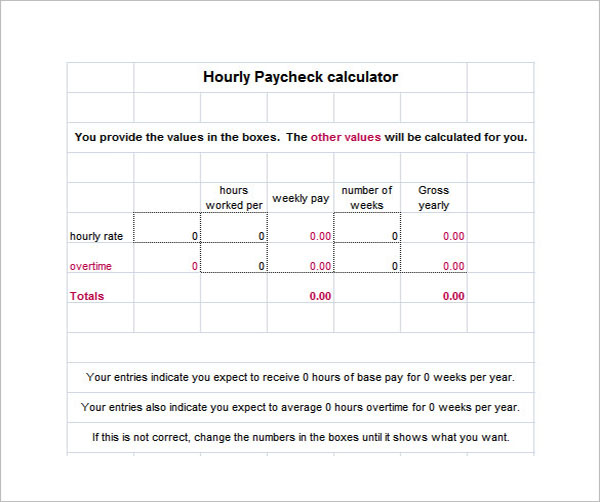

This free, easy to use payroll calculator will calculate your take home pay. Supports hourly & salary income and multiple pay frequencies. Calculates Federal, FICA, Medicare and withholding taxes for all 50 states. In addition to the standard deduction, some types of income are exempt from taxation in Arkansas and may be subtracted from total income to calculate net taxable income. Like most states, Arkansas does not tax Social Security benefits. Next, from AGI we subtract exemptions and deductions to get your taxable income.

Medicare is meant to supplement an employee’s healthcare benefits when they reach retirement age. Both employers and employees are required to contribute to Medicare at a rate of 1.45%. For employees, there is an additional 0.9% Medicare tax on wages earned after a $200,000 threshold.

The state of Arkansas

It's your employer's responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. The state income tax system in Arkansas is a progressive tax system. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Arkansas is unique in that their tax brackets do not vary based on filing status.

So anything you do not use over that amount, you will lose. When you received your first paycheck from your first job, it may have been considerably lower than you were expecting based on the salary you were quoted. That’s because you can’t simply divide your annual salary by 52 to determine your weekly wages. Your actual paycheck is less than that because your employer withholds taxes from each of your paychecks. All you have to do is input wage and W-4 information for each employee into the calculator, and it will do the rest.

Kansas Median Household Income

It's also worth noting that in Kansas, local jurisdictions may impose income tax on earnings derived from interest, securities, and dividends. At the county level, this rate is just 0.75% and the highest city and township rate is 2.25%. Additionally, if you have a health insurance or life insurance plan through your employer, any premiums you pay will come out of your wages. Bonuses are taxed more than regular pay because they are considered supplemental income. They are always federally taxed, no matter which tax bracket you’re in.

A flexible spending account is a tax-advantaged account that is usually offered by employers to their employees so they have the ability to set aside some of their earnings. Because contributions into an FSA are deducted from paychecks during payroll before income taxes, less income will be subject to taxation. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes. Currently, there are three tax brackets in Kansas that depend on your income level.

Are bonuses taxed differently than regular pay?

Yes, Arkansas does have income tax that residents are required to pay. Use the Arkansas salary paycheck calculator to see your take home pay after taxes. Calculate your Arkansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal, state, and local W4 information into this free Arkansas paycheck calculator. To find an estimated amount on a tax return instead, please use our Income Tax Calculator. Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years.

For example, your employer will deduct money from each of your paychecks if you make contributions to retirement plans, such as a 401, or health plans, such as a health savings account . Again, the percentage chosen is based on the paycheck amount and your W4 answers. For those who do not use itemized deductions, a standard deduction can be used.

These contributions support unemployment payments for displaced workers. Alternatively, use the Arkansas State Salary Calculator and alter the filing status, number of children and other taxation and payroll factors as required to produce your own, detailed salary illustration. You’ve checked payroll taxes off your to-do list so you can focus on growing your business. Once each employee’s net pay is calculated , you’re good to go. For Medicare tax, withhold 1.45% of each employee’s taxable wages until they have earned $200,000 in a given calendar year.

All you need to do for this is fill in the appropriate line on your W-4 with how much you want withheld. Depending on how much you overpay, you may get some of this extra money back come tax season. As a result, you might choose to do this if you tend to owe a lot when you file your taxes. In our paycheck calculators, SUI is used to refer to the unemployment tax paid by the employee. SUTA and SUI are payroll taxes that employers, and in some states employees, have to pay to their state unemployment fund.

The sad truth is that a lot of people fear making a mistake on their Arkansas tax return and subsequently facing fines and issue with the IRS and or Arkansas State Government tax administration. A full list of tax exemptions and elements which can be claimed as part of an itemised Arkansas state tax return is available on the Arkansas Government website. The money for these accounts comes out of your wages after income tax has already been applied. The reason to use one of these accounts instead of an account taking pre-tax money is that the money in a Roth IRA or Roth 401 grows tax-free and you don’t have to pay income taxes when you withdraw it . If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. You can also fine-tune your tax withholding by requesting a certain dollar amount of additional withholding from each paycheck on your W-4.

If you make contributions to a retirement plan like a 401 or a health savings account , that money will also come out of your paycheck. However, those contributions come out of your paycheck prior to taxes, so they lower your taxable income and save you money. The aggregate method is used if your bonus is on the same check as your regular paycheck. Your employer will withhold tax from your bonus plus your regular earnings according to your W-4 answers. Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security.

On the first $10,000 in wages paid to each employee in a calendar year. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Your location will determine whether you owe local and / or state taxes. In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty. However, depending on the severity of the financial situation, a case could be made for at least contributing as much as possible towards what an employer will match for a 401. Figures entered into "Your Annual Income " should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount .

Comments

Post a Comment